This blog post is in response to the healthcare-economist’s post: which presents several case-studies from big firms namely

Samsung, Apple, CVS, AT&T, Time Warner and Google efforts in improving

healthcare and consumer-oriented health technologies, and questions, “At a time

when money is pouring into targeting digital health, price transparency,

workflow and electronic medical records systems and population health

management, which company would be health-care’s Amazon.com?” (Amazon being a

metaphor).

From the recent post in the same blog, it seems Amazon has started surveying the sector, by having

a health tech team called 1492 working on medical records, virtual doc visits

and another unit exploring selling pharmaceuticals. A recent report

that Amazon had acquired pharmacy wholesaler licenses also sparked a major wave

of excitement in the industry. Although, the licenses Amazon applied for happen

to cover the distribution of medical-surgical equipment, devices, and other

healthcare related equipment, a business they are in today, but, Amazon could very

well become a "Verified Accredited Wholesale Distributor" (VAWD) by

the National Association of Boards of Pharmacy (NABP), and spend a portion of

its $16 billion annual R&D budget to acquire state licenses, build the

software/hardware and teams needed to start pharmacy operation. So, it won’t be far-fetched to say

the company that would be healthcare’s Amazon.com would be Amazon.com itself.

This post goes on to explore the problems currently faced by healthcare sector

and how would it benefit from Amazon’s advent, along with types of

technological advancements and innovations Amazon could bring which synergizes

with its core strengths.

One of the burning issues which U.S.

deal with is the outrageous cost of prescription medicines. U.S. Prescription

drug prices are among the highest in the world. On the campaign trail,

President Trump said drug companies were “getting away with murder.” One such

instance was in 2015 when the price of Daraprim, which is used by AIDS and

transplant patients, famously soared from $13.50 per pill to $750, which

sparked an outrage. Have we ever wondered why the cost of drugs are so high?

Even though, there are multiple factors contributing to the cost, some of which

includes R&D, marketing, taxes imposed by manufacturer, however, we’ll be focusing

on profits, contracts of multiple middlemen (wholesaler, pharmacy and pharmacy

benefit managers) in this post. From when you pick up a drug at the pharmacy,

you often don’t know what its real price is — that is established between the

manufacturer and your insurer. You just pay the agreed-upon copay rate. Today,

insurance companies rarely negotiate prices directly with drug manufacturers.

Instead, most insurers work with pharmacy

benefit managers (PBM), who negotiate rebates and discounts on the

company’s behalf — often in exchange for preferential placement on their list

of covered medicines.

Also, it’s a misconception that the reason why these

drugs are so expensive is because of brand medications. In reality, only 2% of

American consumers pay out of pocket for the brand medications. The large group

of people are the people in the middle who are paying for generic medications.

And for generic medications, drug manufacturers quote an average wholesale price,

but, they do not control the retail price that is submitted by the pharmacy.

The retail price includes - profit margins, administrative staff, cost of

capital and operating costs of wholesaler, pharmacy and PBMs, before reaching

the health insurer or consumer. This is where Amazon could step in. Amazon

could revolutionize and re-engineer the wheel of how middlemen (wholesaler,

PBM, pharmacy) works, by not only

negotiating stronger terms with the pharmaceutical companies, leveraging their

large trusting consumer base (including insurance companies and uninsured),

but, also, consolidating middlemen (by purchasing directly from manufacturer).

This would impose universal margin and transparency which in turn would put

pressure across the entire ecosystem and starch out all the margins from the

brands, which thrive on lack of transparency and give it back to the consumers.

Hence, there's no reason the

e-commerce behemoth couldn't use this buying power to offer customers cut-rate

generics for cash, which would appeal to uninsured patients and those on

high-deductible plans and eliminate numerous markups

along the way or pare back to capture market share by becoming the ultimate

buyer of cheap generics. Also, to gain access to the far larger market of insured patients, Amazon

could cut deals with insurers that aren't already heavily focused on mail drug

delivery.

So,

why Amazon? Amazon has shown that they have mastery of the technology and

innovative approaches to really transform how the marketplace delivers product.

After transforming such industries as publishing,

consumer electronics and cloud services,

Amazon has built a reputation for dominance. Its core competencies lie in Retail

Online Shopping Platform, Consumer Relationship (Trust), AMZN

Prime Branding & Payment Info, Bricks & Mortar Retail, General

Order Fulfillment and Customer Servicing, all of which could benefit

healthcare. Amazon has already made an entry and is setting prices for over the

counter medications (OTC). On average, its OTC products, like Tylenol, are

cheaper on its website than most bricks and mortar stores. Amazon is already

easing in by selling prescription drugs on their Japanese website, perhaps a

test case for an American entry. In April, 2017,

Amazon Japan rolled out a service to Prime members offering same-day delivery

of pharmacy items, such as medicines. For fulfillment, it's teamed up with the

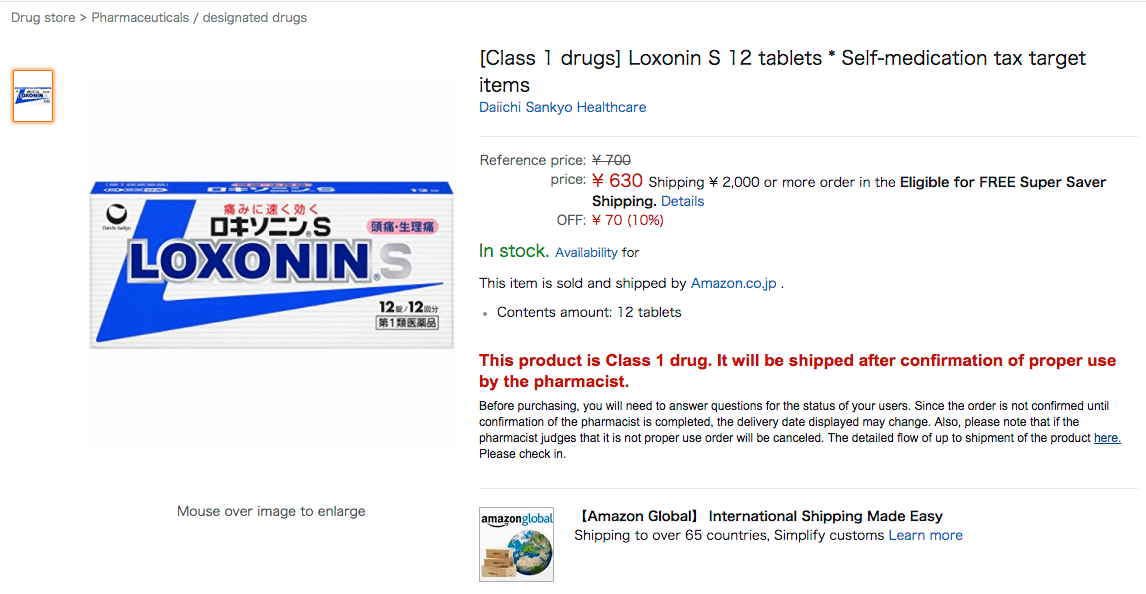

Japanese pharmacy chains Cocokara Fine Inc. and Matsumotokiyoshi Holdings. Amazon.co.jp started selling category No. 1 drugs,

which require consultation with a pharmacist before purchase, at its website.

Before placing orders, customers need to report their symptoms and medical

history via a form on Amazon’s site. Items will only be delivered after

approval by a pharmacist.

So,

why Amazon? Amazon has shown that they have mastery of the technology and

innovative approaches to really transform how the marketplace delivers product.

After transforming such industries as publishing,

consumer electronics and cloud services,

Amazon has built a reputation for dominance. Its core competencies lie in Retail

Online Shopping Platform, Consumer Relationship (Trust), AMZN

Prime Branding & Payment Info, Bricks & Mortar Retail, General

Order Fulfillment and Customer Servicing, all of which could benefit

healthcare. Amazon has already made an entry and is setting prices for over the

counter medications (OTC). On average, its OTC products, like Tylenol, are

cheaper on its website than most bricks and mortar stores. Amazon is already

easing in by selling prescription drugs on their Japanese website, perhaps a

test case for an American entry. In April, 2017,

Amazon Japan rolled out a service to Prime members offering same-day delivery

of pharmacy items, such as medicines. For fulfillment, it's teamed up with the

Japanese pharmacy chains Cocokara Fine Inc. and Matsumotokiyoshi Holdings. Amazon.co.jp started selling category No. 1 drugs,

which require consultation with a pharmacist before purchase, at its website.

Before placing orders, customers need to report their symptoms and medical

history via a form on Amazon’s site. Items will only be delivered after

approval by a pharmacist.

So far we’ve talked about how Amazon could bring down the

cost of generic medicines in the pharmaceutical industry. But, there’s more to

Amazon than a big wholesaler which could cut cost, and that is, it’s mammoth,

customer-centric and innovative distribution network. This brings us to the

question of whether there’s a market for Amazon’s home-delivery or a scope of

improvement in how pharmaceutical medicines are dispensed in U.S. Let’s see,

wouldn’t it be a relief to have an app, which can get you prescribed medicines

and get it delivered at your doorstep? This is not entirely a new idea.

Pharmacy Benefits Managers such as CVS Caremark and Express Scripts have explored mail service, but, despite their best efforts, mail

order pharmacies only fill a paltry 1 out of every 10 prescriptions. Most of

the 4 billion prescriptions dispensed in the U.S. every year are filled at one

of 60,000 retail pharmacy locations. That should seem surprising, as the vast

majority of prescriptions are refills of ongoing medications. And that makes it

ideal for home delivery. Also, to date the one area of true weakness for mail

order pharmacy services has been providing essential prescriptions immediately,

say, on the day a patient is discharged from the hospital. That’s a weakness

Amazon could easily topple with its massive logistics operation and Prime Now, its same-day one-hour

delivery service. On

top of that, Amazon's low prices, same day or next day delivery and free

shipping would likely provide benefit to the refills and spur competition among

distributors and pharmacies. Not only e-commerce and mail order

pharmacy, Now that

Amazon owns Whole Foods, it has a physical presence in which it could set up

pharmacies or pickup points in addition to a mail or same-day-delivery

operation. In addition to Whole Foods, Amazon could supplement this by

partnering with local independent pharmacies, allowing patients to order medicines

online for pickup at these stores. This

is where ‘Just Walk Out Technology’

stores like AmazonGo could deal with frustrating long

queues, prolonged waiting time and the need of presenting the insurance card

for every visit. It would also help the visitor by specifying the aisle and the

exact position of their drug after they enter and their prescription profile

get scanned under Amazon’s wireless technology (advance mesh of machine

learning, AI and computer vision).

Now, Amazon could easily capitalize this above described

distribution network and it’s e-commerce platform by seamlessly integrating it

with many upcoming technologies coming in the health sector like telemedicine, by providing the process of ordering prescription drugs from its

website into the virtual visit experience of major telemedicine vendors. By

doing this, the common workaround of the physician having to find a pharmacy

near the patient to send in the prescription can be overcomed. From the

perspective of the sick patient, being allowed to opt-in to medication delivery

prevents the need to leave the house to pick up the prescription, improving the

patient experience for many illnesses. Its new own personal assistant technology Alexa,

for example, may be able to remind patients to take their medication, send an

order to refill a prescription without the necessity of getting online on the

app, or assist in scheduling a telemedicine appointment all by voice command in

the home. Amazon’s dash-buttons

could work like wonders for the senior age group who are not that tech savvy.

Additionally, Amazon’s Subscribe & Save, makes it even more appealing by

reducing the cost and sending them each time as per its scheduled. Amazon's customers

already use this option to subscribe to products that show up on a schedule,

and it wouldn't seem to be a deal-breaker to develop a system that would make

it easy for healthcare providers to send in prescriptions for patients, either.

Amazon also has a ton of experience in data management and analysis that could

provide this with an edge.

These additional experiences could be included with an order from the online

pharmacy, and hold potential to make monitoring and compliance easier for

patients with chronic conditions. In this way, Amazon can keep patients

healthier and providers happier, and improve the likelihood that they turn to

Amazon in the future.

However, every new venture comes with its own set of

challenges. Pharmacy is the

highly regulated drug business that has never been particularly transparent. At

best, U.S. drug pricing is complex; at worst, it’s dysfunctional. Amazon

usually has difficulty breaking into highly regulated markets. For

example, the company hasn’t had much success in China, and has a limited

presence in alcohol distribution in the U.S.. Another one in the box could be:

because of the focus on outrageous medicine costs, the current political and social environment is

unfriendly toward PBMs and drug makers and comes with its own risks.

Furthermore, regarding the pharmaceutical history of patient, there are some stringent

regulations that FDA has asked to adhere to that ensure the protection of the

data. If you think Amazon can do no wrong, remember this is the company that

thought it would be a good idea to emblazon Amazon.com on the back of its Fire

Phone, a complete flop. Amazon can’t afford a flameout in healthcare, and

making another transformative purchase that could easily eclipse the purchase

of Whole Foods so soon. Regardless of how Amazon's plans shake out, patients

will be watching closely in hopes that even the threat of a new low-cost

competitor can provide some relief to sky-high drug prices.

Something tells me that

something big is going to happen in pharmacy - and soon. Maybe there's even an

opportunity for a combined distribution, pharmacy, and PBM. It's hard to

believe any company is better positioned to make one or all of these happen

than Amazon.

Amazon’s customer base

may be young, averaging 35 years old, but they are aging and in the midst of

the child-rearing cycle, which requires frequent trips to the pharmacy.

Amazon’s customers will need more prescriptions for themselves and for their

children. Soon an entire generation will be even more used to buying things

online. Right now Amazon has announced it is preparing to make decision whether

or not it will get into healthcare. If Amazon wants to capture as much of the

purchasing a customer can do, it will need to mature with its consumers and

formally enter into the healthcare market.

If Amazon can accomplish this, it will be set to break into the pharmacy

space in a big way, just as it has changed the face of numerous other

industries.

Hi Avneet this is remarkable and very innovative.the marketing kings on the globe AMAZON can play a pivot role in this context and deliver the medicines not only to the needy but also at an affordable price.I wish you all the best in this endeavour and I am sure many more colleagues will accept this innovation of yours. I wish Amazon authorities also to put their best foot forward so as to create a positive awareness on this so as to help the community at large.

ReplyDeleteHey Avneet! It was a good read and very informative. A little technical for me but you have written it a really lucid manner!

ReplyDelete